Do you know how criminals manage to smuggle dirty money into banks? Smurfing enables criminals to move small, illegal cash without arousing suspicion.

One expert summarized this, “When crooks use tricks to hide money, it hurts everyone who uses banks.”

smurfing meaning in banking is the trick that the robbers do to hide money from the banks and police. They break huge, large piles of cash into small amounts below the limits for reports.

Then, they slowly “deposit” and “take out” these small piles to make the dirty money appear to be clean.

This allows the illegal funds to blend with the clean cash in the banks. This article will outline step by step how smurfing works and what banks do to prevent it from happening.

What is Smurfing?

Slow laundering of dirty money in banks using sneaky tricks to avoid detection is known as Smurfing.

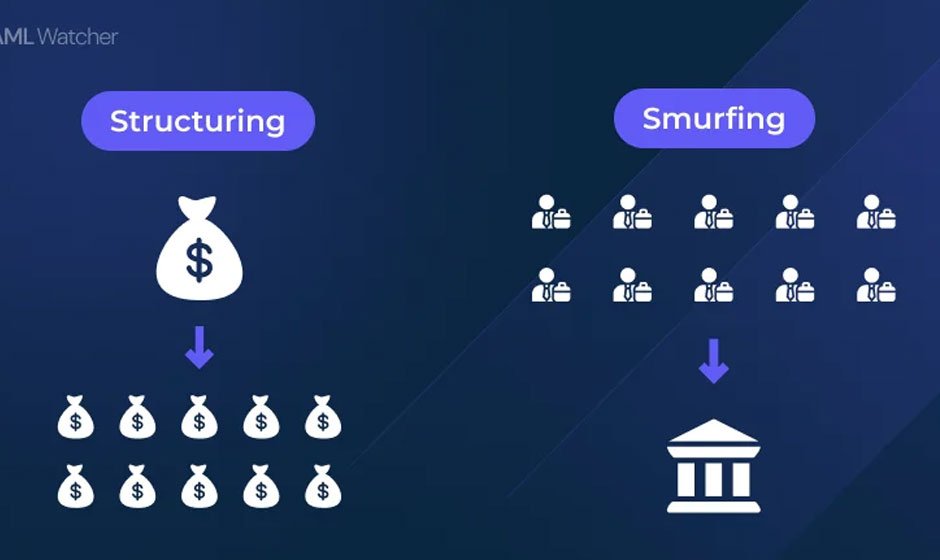

“Smurfs” is the term for these people who break big lumps of cash into little pieces under the reporting limit using a technique called “structuring.”

By doing so, smurfs can sneak past the AML checks that banks run to identify suspicious activity with drug or scam money.

Smurfing is an allowance for the bosses to slowly launder or clean their dirty money without raising any red flags within the banking systems.

Bonus: Learn how criminals exploit AML smurfing by learning about smurfing. Find out what you can do to help local banks prevent financial crime on our website.

Money Laundering through Structuring

When smurfs loot massive amounts of money from drug or fraud operations, they cannot stuff all of them into the bank.

Banks are required to file any deposits exceeding $10,000 with the authorities through a process known as a CTR or cash transaction report.

To avoid such AML screens, then the Smurfs arrange multiple deposits under $10,000 per day.

They also diversify the ill-gotten gains in many accounts so that they look like actual business and not like crime earnings.

How Smurfs Operate Deposits and Withdrawals

Smurfs will enter into thousands of branches of the same giant bank or use hundreds of small banks to split and deposit their illicit funds daily.

They ensure each visit to the branch only has a deposit that falls below the reporting threshold established.

After a long time, they shall gradually withdraw the “cleaned” money in the same small denominations.

All these trips deceive the banks’ AML systems so the illicitly obtained money can flow in and out of the financial system undetected. With more than $2 trillion laundered around the world every year.

Red Flags and Detection Challenges

It’s more complicated for banks to spot smurfing schemes. Their AML teams have to identify some kinds of warning signs or “red flags” that indicate deposits are structured.

Things such as lots of identical transactions below the reporting limits, visits to many branches in one area, and funds withdrawn might hint at smurfing.

Smurfs know how to space things out to avoid those red flags and fool banking AML screening processes.

New detection technologies that start to recognize patterns in transactions catch more smurfs. AI-powered tools have reported up detected transactions by more than 30 percent.

Banking Regulatory Requirements

To combat money laundering, regulators demand that banks have strict anti-money laundering programs in place.

This includes due diligence checks on customers, reporting on cash transactions that exceed $10,000, and systems put in place to monitor accounts for suspicious transactions.

If they do not follow through, they are hit with big fines. Smurfing is among the schemes trying to circumvent these anti-money laundering measures.

Customer Due Diligence Procedures

Banks must scrutinize new customers and scrutinize financial activity by existing customers much better if smurfing is suspected.

The entire system includes verifying identity, occupation, and source of funds. Politically Exposed Persons from countries with corruption issues receive extra attention.

ASAR report released last 2023 revealed that smurfing-related SARs have risen by 20%. If there is due diligence, banks can put account activities under review or close accounts.

Enhanced Monitoring Practices

When red flags are triggered, banks have to keep a closer watch on suspect accounts. Transactions come under strict analysis to catch unusual patterns that might suggest a scheme of smurfing.

Even new software catches the network analysis of linked accounts. AI has also been used to enhance the detection of smurfing behavior in banking data over time.

In 2023, data reflected a 15% rise in suspicious activity filings involving smurfing because of these advanced technologies.

Powerful reviews of clients aimed to catch any form of smurfing in banking or other money laundering tricks.

They are more cooperative with each other and with the police as well if suspicious activity consistent with known smurfing methods occurs.

Stiff Penalties for Non-Compliance

The regulators may impose enormous fines in case of default in AML rules, and the global fine in 2023 was more than $15 billion.

Reputation is damaged when the names of banks are heard about financial crimes. Even in extreme cases where smurfing is deliberately ignored, the bank may lose its license to operate.

That is why banks spend high on their systems of AML screening and training analysts. Being a stride ahead of the money laundering modalities developed by Smurfs keeps the business going.

As the art of money laundering changes, so do the defenses against the techniques. Find out how your organization can join forces with us to strengthen controls over anti-money laundering.